Transport monitoring: the CIS vs the West

this article will try to grasp the immensity, namely: to compare the market of transport monitoring in the Russian Federation and the West and hold between them the analogy.

This article does not pretend to the presentation of the material in full, giving concrete figures of market size: it is limited to the trends that are visible now.

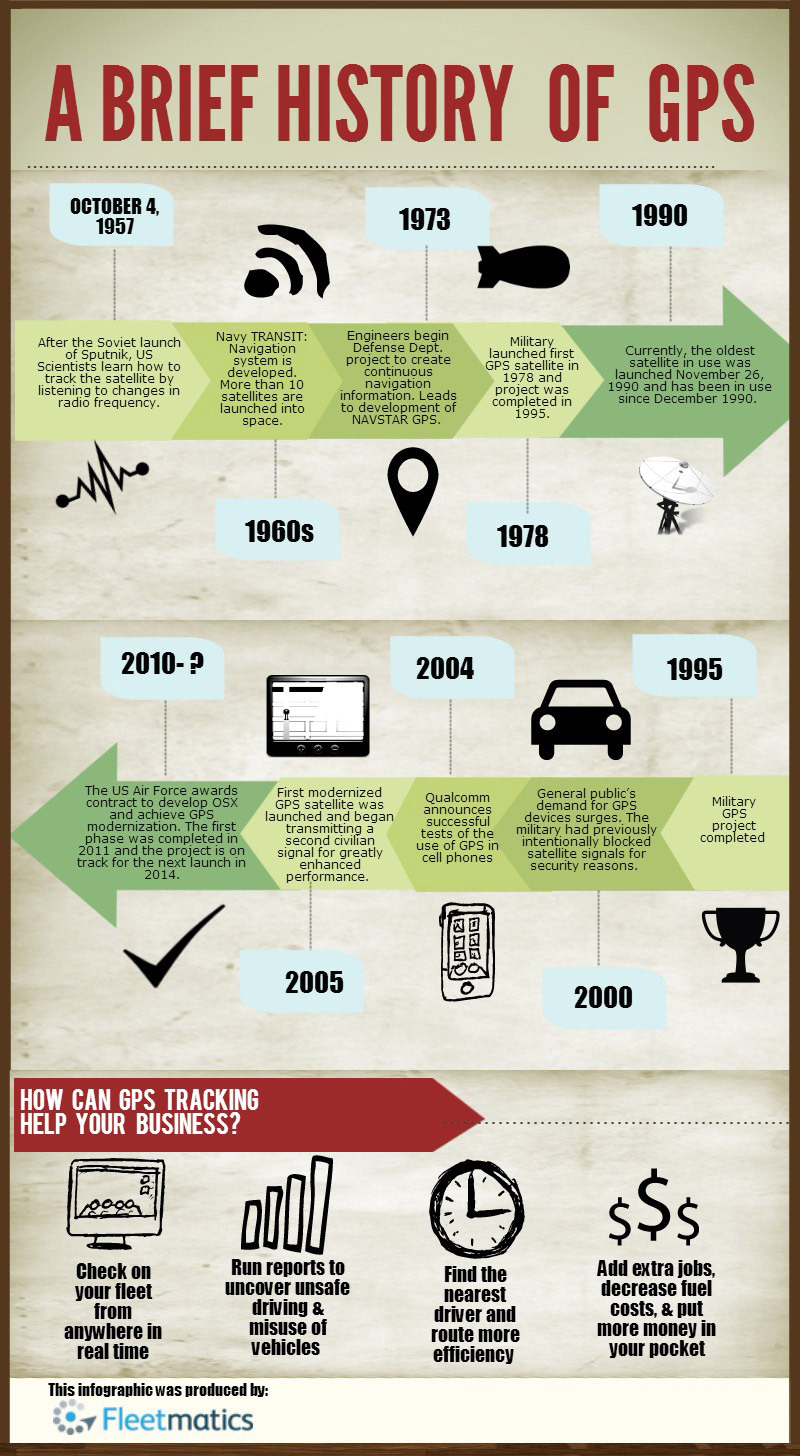

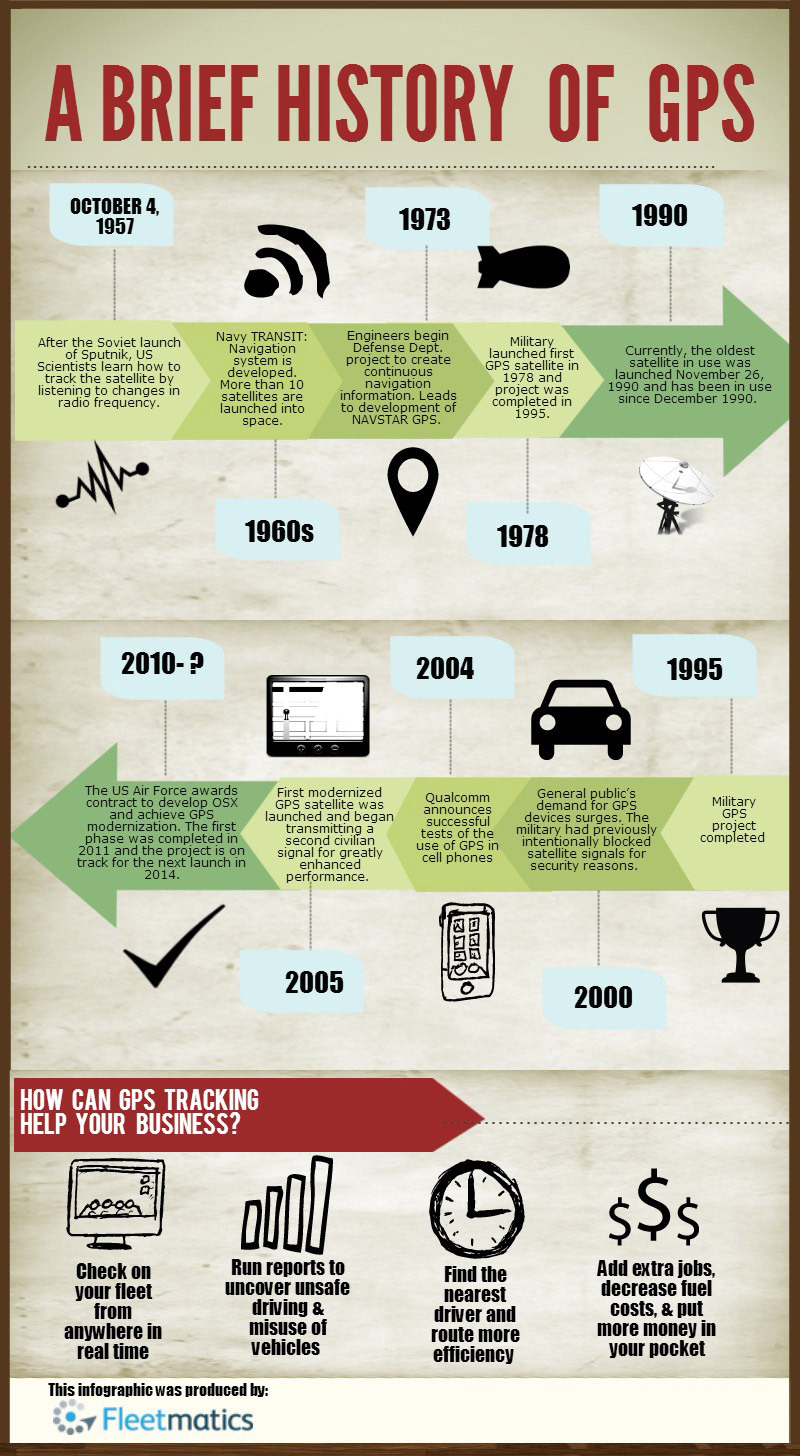

For a start I suggest going back to the roots ‒ where to start monitoring. And it began, as all have guessed, in the West. When the cost of a mobile phone has fallen from heights (mid 90-ies), manufacturers of mobile electronics began to look for new markets. But a new market in the form of monitoring of transport did not appear immediately, because monitoring was an important positioning accuracy. Namely, the determination of the position with minimum error for civilian purposes was impossible, because the original GPS was developed as a purely military project for precision-guided missiles at fixed, and then on the moving objects in the air and on the ground. And only in 2000. desensitization is exactly canceled by decree of the President of the United States bill Clinton. It 2000 can be considered a starting point in the development of vehicle monitoring.

In the early 2000s began to appear the first devices that can be installed on the vehicle and monitoring. Later, these devices began to deliver to Russia. The second problem that stood in the way of large-scale use of monitoring of transport is coverage of cellular networks GPRS. That is why the first car terminals gave the coordinates in the SMS messages. A software Manager could see the "point on map" that identified the location of the vehicle.

But since then much time has passed, and a monitoring system of transport in Russia and in the West stepped far forward, choosing their path of development. Maybe something even copying each other. Let's consider in more detail those markets currently. The depth of penetration in the markets of Russia and the West, we will compare the availability of commercial services in these two markets.

the

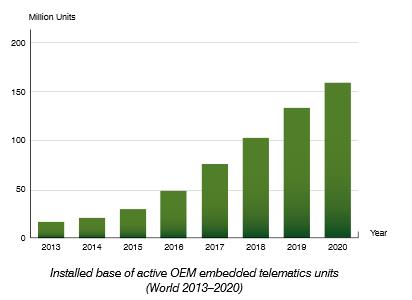

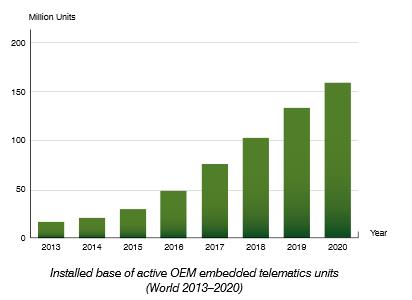

Commercial services are developing a large number of companies. As far as these companies are popular, you can indirectly judge by the number of vehicles connected to their software platform. In the West in the news recently voiced their data Octo Telematics saviv about 3 000 000 connected subscribers and TomTom Telematics 400 000. Also significant players in the international market are MiX Telematics, DigiCore, Navman Wireless, Omnitracs, Teletrac, Telogis, Trimble, Webtech Wireless, Altea ATX Group, Connexis, Eurowatch, Verizon Telematics, WirelessCar, Trafficmaster, Masternaut, Garmin, CIS figures with six zeros while no one was bragging, but there is a company with a clear leadership position, such as var with connected 500 000 vehicles. Recently, the company SpaceTeam said about 40 000 users connected to the telematics platform. The most notable players on the Russian market are Technocom (brand Autograph), APCOM, Galileo, Scout, Omnicomm, Internavigatsia, Fort Telecom, sibsvyaz, ANTOR, STATT, Advantum, Escort, Incotex, Bar, ATOL, CSBI, of ends. Now let us turn to commercial services. In order to avoid confusion in a wide variety of monitoring services, let's divide conditionally on systems that are equipped with the "Assembly line", or as they say in the West, OEM, and aftermarket (Aftermarket). Also select the direction of M2M services for private vehicles and monitoring of commercial vehicles.

the

System of emergency response in case of accidents intended to quickly inform emergency services about road accidents. The essence of the project lies in M2M modules, which are installed in a car on a conveyor system and allow for the accident to determine the exact coordinates and, if necessary, to send this information via cellular communication channels to the emergency services. Currently, pilot projects implementation in the framework of HeERO (Harmonised eCall European Pilot project for the harmonization of the European project eCall), the eight countries of the European Union cost 10 million Euros: the Czech Republic, Finland, Germany, Greece, Italy, the Netherlands, Romania and Sweden. In the Russian ERA GLONASS was already spent 3.5 to 4 billion rubles, but the list of regions where you can see the system in action until declared.

Vehicle vehicle systems eCall and ERA GLONASS is expected initially on the conveyor. In the West, many automobile manufacturers have already launched the production of vehicles support eCall BMW, Mercedes-Benz, PSA Peugeot Citroën, Volvo Cars. In Russia, the conveyor is not reached, but in mass media the information appeared that Lada Vesta will be equipped with a system of ERA GLONASS. System ERA GLONASS interested in the MAN.

But to call emergency response systems, commercial services, probably, not absolutely correctly, therefore, Western brands began to offer additional services which are collectively known as "Connected Car". The connected car "Connected Car" can be attributed to M2M services for private vehicles.

the

I have long thought that another M2M service currently offered by Russian automakers, but to find a name and couldn't. In this direction feel the lag, which is unknown when and by whom will be filled. But the lack of M2M services "from the automaker" can solve the secondary market.

In the West a radically different picture: on the contrary, it is difficult to find a manufacturer who would not have started to work with it company to establish a joint M2M solutions. And there are many examples.

Volkswagen Car-Net telematics services demo video:

Audi Connect telematics service and a video tutorial:

Toyota T-Connect telematics services:

Volvo On Call telematics service):

Who watched the video, must have realized the possibilities that can provide M2M services in the car. If you believe the forecasts of analysts (for Western market), we can assume that the "not connected car" may soon not remain at all.

All in all, the market segment of private vehicles are being used to evaluate the overall situation. Well, next time I will tell you how advanced M2M services for commercial and freight transport, and will share his observations about the services that are offered on the secondary market.

Article based on information from habrahabr.ru

This article does not pretend to the presentation of the material in full, giving concrete figures of market size: it is limited to the trends that are visible now.

For a start I suggest going back to the roots ‒ where to start monitoring. And it began, as all have guessed, in the West. When the cost of a mobile phone has fallen from heights (mid 90-ies), manufacturers of mobile electronics began to look for new markets. But a new market in the form of monitoring of transport did not appear immediately, because monitoring was an important positioning accuracy. Namely, the determination of the position with minimum error for civilian purposes was impossible, because the original GPS was developed as a purely military project for precision-guided missiles at fixed, and then on the moving objects in the air and on the ground. And only in 2000. desensitization is exactly canceled by decree of the President of the United States bill Clinton. It 2000 can be considered a starting point in the development of vehicle monitoring.

In the early 2000s began to appear the first devices that can be installed on the vehicle and monitoring. Later, these devices began to deliver to Russia. The second problem that stood in the way of large-scale use of monitoring of transport is coverage of cellular networks GPRS. That is why the first car terminals gave the coordinates in the SMS messages. A software Manager could see the "point on map" that identified the location of the vehicle.

But since then much time has passed, and a monitoring system of transport in Russia and in the West stepped far forward, choosing their path of development. Maybe something even copying each other. Let's consider in more detail those markets currently. The depth of penetration in the markets of Russia and the West, we will compare the availability of commercial services in these two markets.

the

Major players

Commercial services are developing a large number of companies. As far as these companies are popular, you can indirectly judge by the number of vehicles connected to their software platform. In the West in the news recently voiced their data Octo Telematics saviv about 3 000 000 connected subscribers and TomTom Telematics 400 000. Also significant players in the international market are MiX Telematics, DigiCore, Navman Wireless, Omnitracs, Teletrac, Telogis, Trimble, Webtech Wireless, Altea ATX Group, Connexis, Eurowatch, Verizon Telematics, WirelessCar, Trafficmaster, Masternaut, Garmin, CIS figures with six zeros while no one was bragging, but there is a company with a clear leadership position, such as var with connected 500 000 vehicles. Recently, the company SpaceTeam said about 40 000 users connected to the telematics platform. The most notable players on the Russian market are Technocom (brand Autograph), APCOM, Galileo, Scout, Omnicomm, Internavigatsia, Fort Telecom, sibsvyaz, ANTOR, STATT, Advantum, Escort, Incotex, Bar, ATOL, CSBI, of ends. Now let us turn to commercial services. In order to avoid confusion in a wide variety of monitoring services, let's divide conditionally on systems that are equipped with the "Assembly line", or as they say in the West, OEM, and aftermarket (Aftermarket). Also select the direction of M2M services for private vehicles and monitoring of commercial vehicles.

the

eCall and ERA GLONASS

System of emergency response in case of accidents intended to quickly inform emergency services about road accidents. The essence of the project lies in M2M modules, which are installed in a car on a conveyor system and allow for the accident to determine the exact coordinates and, if necessary, to send this information via cellular communication channels to the emergency services. Currently, pilot projects implementation in the framework of HeERO (Harmonised eCall European Pilot project for the harmonization of the European project eCall), the eight countries of the European Union cost 10 million Euros: the Czech Republic, Finland, Germany, Greece, Italy, the Netherlands, Romania and Sweden. In the Russian ERA GLONASS was already spent 3.5 to 4 billion rubles, but the list of regions where you can see the system in action until declared.

Vehicle vehicle systems eCall and ERA GLONASS is expected initially on the conveyor. In the West, many automobile manufacturers have already launched the production of vehicles support eCall BMW, Mercedes-Benz, PSA Peugeot Citroën, Volvo Cars. In Russia, the conveyor is not reached, but in mass media the information appeared that Lada Vesta will be equipped with a system of ERA GLONASS. System ERA GLONASS interested in the MAN.

But to call emergency response systems, commercial services, probably, not absolutely correctly, therefore, Western brands began to offer additional services which are collectively known as "Connected Car". The connected car "Connected Car" can be attributed to M2M services for private vehicles.

the

the Connected Car

I have long thought that another M2M service currently offered by Russian automakers, but to find a name and couldn't. In this direction feel the lag, which is unknown when and by whom will be filled. But the lack of M2M services "from the automaker" can solve the secondary market.

In the West a radically different picture: on the contrary, it is difficult to find a manufacturer who would not have started to work with it company to establish a joint M2M solutions. And there are many examples.

Volkswagen Car-Net telematics services demo video:

Audi Connect telematics service and a video tutorial:

Toyota T-Connect telematics services:

Volvo On Call telematics service):

Who watched the video, must have realized the possibilities that can provide M2M services in the car. If you believe the forecasts of analysts (for Western market), we can assume that the "not connected car" may soon not remain at all.

All in all, the market segment of private vehicles are being used to evaluate the overall situation. Well, next time I will tell you how advanced M2M services for commercial and freight transport, and will share his observations about the services that are offered on the secondary market.

Comments

Post a Comment